Note that the extension must be postmarked by the April 18 deadline also.Īlso, a key disclaimer – an extension of time to file is not an extension of time to pay. If, for one reason or another, you are unable to file your tax return by the Aptax deadline, you can file for an IRS tax extension. Tax Extension Application Filing Deadline You must attach a statement to your return explaining which of the two situations qualify you for the extension. If you qualify as being out of the country, you will still be eligible for the extension even if you are physically present in the United States.

Those in military or naval service outside the United States and Puerto Rico (there is additional lenience for those in a combat zone, contingent operation, or who have been hospitalized). Those who live outside the United States and Puerto Rico and main place of work is outside the United States and Puerto Rico, or. Those eligible for this later date include: If you are out of country, you typically have an additional two months to file your taxes (from the typical April 15 date). Your tax filing deadline and payment deadline, if you are out of country, is Wednesday, June 15, 2022.

When is the Tax Deadline if I’m Out of the Country? You can also open new accounts to contribute to up until the same date, which is great news for savers.

This means you have a few additional months to contribute for the tax and calendar year, beyond the actual tax and calendar year end. Note that the HSA contribution deadline and IRA contribution deadline also fall on the same day as the tax deadline. Note: the HSA Contribution Deadline and IRA Contribution Deadline are the Same as the Tax Deadline I could see a few states extending their deadlines. There hasn’t been any official word from the IRS, but I do not anticipate a tax deadline extension in 2022. With COVID challenges, the tax deadline has been extended in recent years to provide more time for taxpayers and the government to get things together. Will there be an Extended Tax Deadline in 2022? If you e-file your taxes, you must do so by April 18 as well. The same rule applies for e-filing your taxes. So if you mail out your tax return on April 18 by USPS mail and the IRS receives your tax return after that date, your return won’t be considered late.

Instead, it refers to the date that the tax return is postmarked. The April 18 tax deadline does not refer to when the IRS receives your tax return.

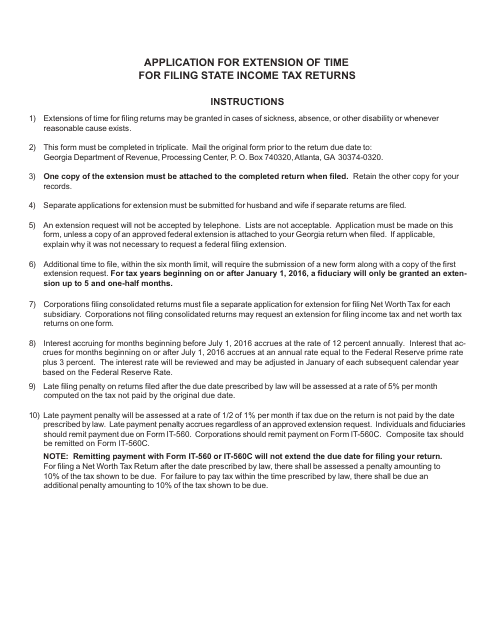

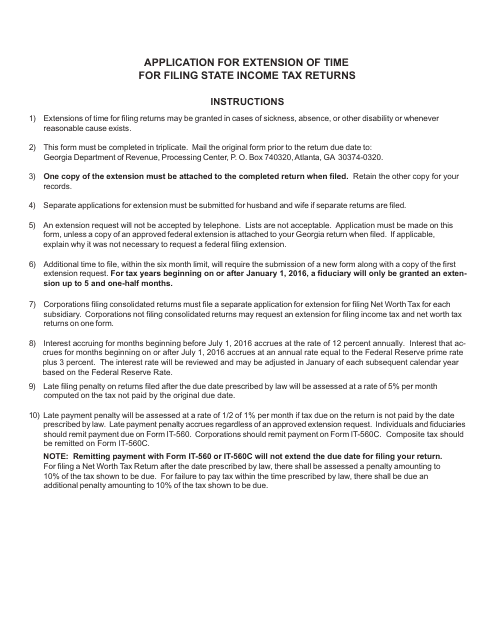

May 16: there are extended deadlines for the victims of natural disasters that happened within specified times/locations for Colorado (wildfires) and Arkansas, Illinois, Kentucky and Tennessee (storms and tornadoes). April 19: 1 extra day for Maine and Massachusetts (state holidays). There are some early exceptions to this standard: If the standard tax deadline falls on a weekend (including Fridays) or a holiday, it is typically pushed to the next business day. This falls a few days after the typical tax deadline of April 15, which falls on a Friday. The IRS tax deadline to file your tax return will be Monday, April 18, 2022. If you are unable to file electronically, call (518) 457-5431 and request a form.When is the 2022 Tax Deadline for Filing (for the 2021 Tax Year)? To use our Online Services, create an account, log in, and select File a corporation tax online extension. Form CT-5.9-E, Request for Three-Month Extension to File Form CT-186-E (for telecommunications tax return and utility services tax return)įile using our Online Services or your NYS approved e-file software. Form CT-5.9, Request for Three-Month Extension to File (for certain Article 9 tax returns, MTA surcharge, or both). Form CT-5.6, Request for Three-Month Extension to File Form CT-186 (for utility corporation franchise tax return, MTA surcharge return, or both). Form CT-5.4, Request for Six-Month Extension to File New York S Corporation Franchise Tax Return. Form CT-5.3, Request for Six-Month Extension to File (for combined franchise tax return or combined MTA surcharge return, or both). Form CT-5, Request for Six-Month Extension to File (for franchise/business taxes, MTA surcharge, or both). If you're e-filing with approved software or using our Web File online service and want to read the form instructions, see the corporation tax extension request instructions. You may file the forms listed below online. Most corporation taxpayers are required to file their extensions electronically. You can file all other extension requests online. Request for Additional Extension of Time to File (for franchise/business taxes, MTA surcharge, or both)

Laws of New York State (New York State Legislature)Ĭorporation tax extension request forms (current year) Corporation tax extension request forms (current year) Form number. Laws of New York State (New York State Senate).

0 kommentar(er)

0 kommentar(er)